Everyone has a right to get literate, but how can you afford the high school fees in this economic crisis? So, the solution is a student loan.

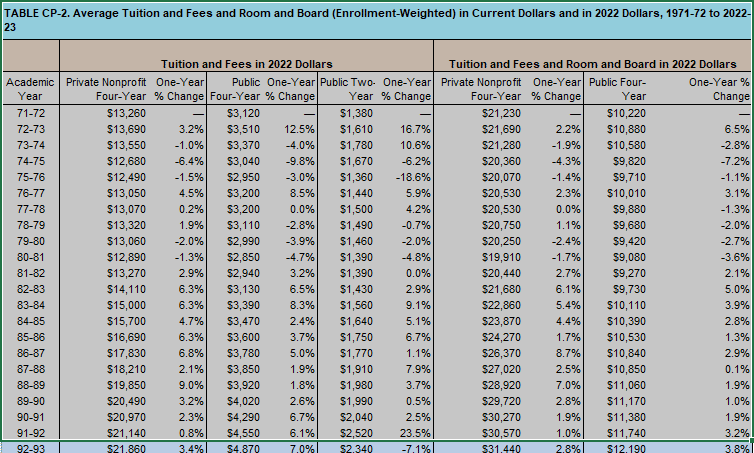

Students in the USA are facing affordability issues because of the increasing fees. Let’s see some stats on how it becomes necessary for students to take insurance loans.

If you want to go to college, you will probably have to get a student loan to pay for it. According to the College Board, the average tuition and fees for an in-state student at a public university in 2021–2022 were $10,740. For a private school, the price went up to $38,070.

Federal aid might not cover all of the costs of going to college. In that case, getting private student loans can help make the difference.

But which lenders have the best benefits and lowest rates? We’ve listed the best private student loan lenders available today to help you find the best one.

ALSO READ: Permanent life insurance – How it works? Complete Guide

Best Student Loans of November 2022

- Best Student Loan Marketplace: Credible

- Best Overall: Rhode Island Student Loan Authority

- Best Interest Rate: College Ave

- Best Student Loan Consolidation: Splash Financial

- Best Parent Student Loan: College Ave

- Best for International Students: MPOWER Financing

- Best for Students Without a Cosigner: Funding U

How do Student loans work?

Student loans are money you borrow from the government or a private lender to pay for college. After graduation, the loan must be paid back, along with any interest that has built up. Most of the time, the loan can be used to pay for school costs like tuition, room and board, books, and other school-related costs. Scholarships and grants, which don’t have to be paid back, are not the same as student loans.

You can apply for a student loan online and fill out your financial information and that of your parents if needed. Depending on the type of loan you want, you might need a specific FICO score or a certain amount of money. Most of the time, you will need more than one student loan to pay for your tuition and other costs. A financial aid counselor at your high school or the college you plan to attend should be able to help you get through the process more efficiently.

What other options are there for student loans?

If you don’t want a student loan or want to know what else you can do, here are some other options:

- Parents pay for college.

- Scholarships based on merit

- Scholarships for athletes

- Aid for work-study

- A savings account or a gift

- Grants

What Kinds of Student Loans Are There?

Most of the time, there are two main types of student loans: federal and private. Alternative loans are another name for private loans.

Federal Student Loans: There are different types of federal loans, but generally, they have lower interest rates and better terms for paying them back than private loans. They may also be easier to get than a private loan because they are more common. Some don’t care about your credit history and have fixed interest rates.

Private student loans: You should look into these after you’ve used up all your federal student loans. Private student loans can be used to pay for things like continuing education without a degree, tuition for people who are not U.S. citizens, and education costs after you graduate.

How Much Do Student Loans Cost?

Interest is the most expensive part of student loans. But some loans may also have fees for starting the loan, paying it off early, or being late. The interest rates on federal loans are usually lower, so it’s best to apply for them first. The interest rate on federal loans for undergraduates is 3.73 percent right now.

Do student loans make sense?

Student loans can be expensive because you must pay an application fee and monthly payments on the principal and interest. They can cost a lot more if you want to go to graduate school, medical school, or law school after a four-year college. If you have another way to pay for college, you should look into that first. Otherwise, student loans are usually worth the cost because you are investing in yourself and your education, which should help you get a higher-paying job or learn the knowledge and skills you need to start your own business.

How We Picked the Best Student Loans for College

There are so many options for federal and private student loans. We looked at many student loans and chose the best ones based on their interest rates, types of loans, need for a cosigner, consolidation options, and how easy it was to apply.

We tried to provide you with information regarding student loans in the USA AS OF 2022. I hope you get all the relevant information through this article. We are open to hearing from your side. Want to read more articles like this, do visit our site.

ALSO READ: Property Insurance – What is Property Insurance and How Does it work?