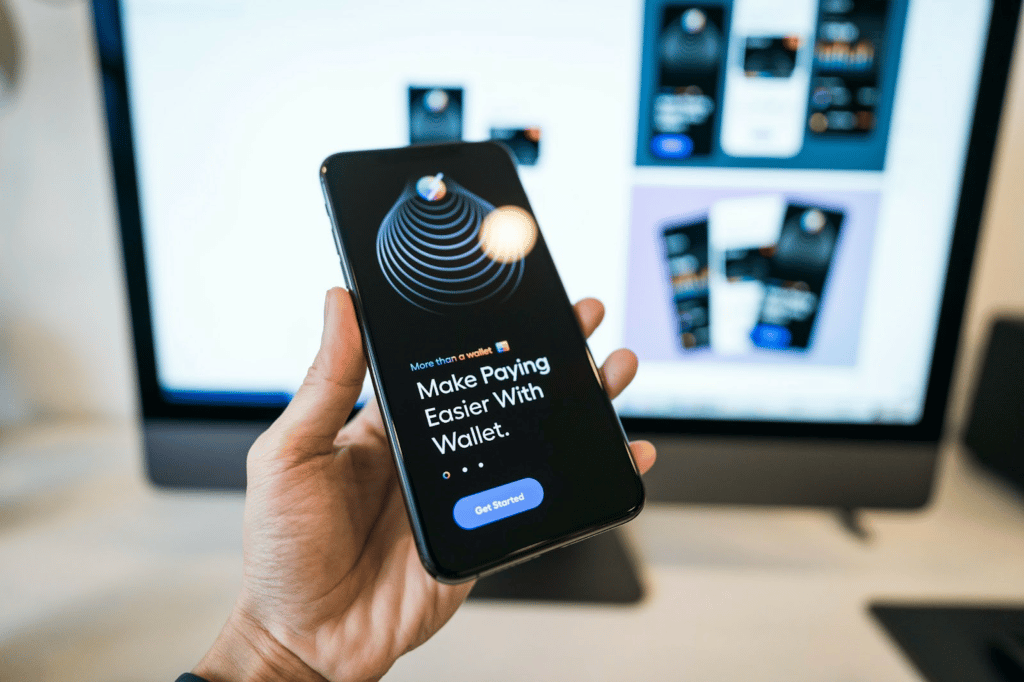

In the very digital world we’re living in right now, digital wallets are essential.

Apps like Venmo, Obopay, Cash App, Google Wallet, and Apple Pay are great alternatives to traditional payment methods such as cash or credit cards. With any of these installed on your phone, you can quickly pay for your purchases online or in stores.

However, every piece of technology and innovation has its pros and cons. One particular downside of e-wallets is that transferring funds from one digital wallet to another can be pretty tricky and expensive. But before we get into why that is the case, let’s learn more about digital wallets, how they work, and more below!

What Are Digital Wallets?

Digital wallets are also referred to as electronic wallets or e-wallets. They are mobile applications that are primarily used for financial transactions. Digital wallets safely store your payment information, including your cards, cash, and bank accounts. You can then use your app to make payments online and in-store.

Simply put, it’s your entire physical wallet in one easy-to-access digital location. This means you don’t even have to carry wads of cash, a mass of cards, or bundles of checks anymore! Instead, just whip out your phone when you need to pay.

However, digital wallets also go beyond money! They can store gift cards, membership cards, loyalty cards, coupons, event tickets, plane and transit tickets, driver’s licenses, IDs, and even car keys.

Many apps also provide their own digital wallets, especially fast-food chains that offer loyalty programs. Starbucks, for example, rewards app users with “stars” that they can exchange for free drinks and other incentives.

How Do Digital Wallets Work?

Digital wallets were designed for you to have access to financial products and services on devices such as computers, mobile phones, or wearable devices like a smartwatch. Due to their ability to safely and conveniently store a user’s payment information, you no longer have to carry a physical wallet with you.

Digital wallets use your mobile device’s wireless capabilities, like magnetic signals, wifi, and Bluetooth, to securely transmit payment information from your device to a point-of-sale system designed to read the data and connect via these signals.

Currently, these are the technologies that most mobile devices and digital wallets use:

- Near Field Communication (NFC) is a technology that connects two smart devices and uses electromagnetic signals to transfer data between them. To connect, both devices must be around 4 centimeters (1 inch) from one another.

- Magnetic Secure Transmission (MST) employs the same technology magnetic card readers use to read your card when you swipe it through a slot at a point-of-sale. Your phone generates this encrypted field, which the point-of-sale terminal can read.

- Quick Response Codes (QR codes) are matrix barcodes that can hold data. To start a transaction, you utilize the camera on your device and the scanning feature of the wallet.

For your digital wallet to work, you need to either have funds available in your wallet or link your card or bank account information. It’s pretty easy to add money to your digital wallet, as you can do so through an online money transfer from your bank account, credit card, or other digital wallets. That last one might prove to be a tad bit tricky, though.

Why Is It Difficult To Transfer Money From One Digital Wallet To Another?

Money transfers should be easier when you use digital wallets. However, wallet-to-wallet transfers aren’t as smooth as when registering your bank account in your digital wallet.

Direct money transfers from one digital wallet to another are virtually impossible. The reason this happens is because of the unique configurations that each platform offers, some of which may not be compatible with other wallets.

Users may not be able to make direct transfers whenever they desire due to providers’ conflicting transaction rules.

The best way to move money from one digital wallet to another is to send the money to your bank account first, link that account to your other digital wallet, and then withdraw the money from that account. Although it isn’t the most practical setup, it’s worked for most users.

It’s a good thing some digital wallets have partnerships with each other nowadays! This allows you to transfer money for free and without the aid of a third-party platform. For instance, Neteller and Skrill enable customers to send money to digital wallets like WebMoney and AstroPay.

Are Digital Wallets Safe?

If it’s cybersecurity threats you’re concerned about, digital wallets are actually pretty safe. They’re even more secure than physical cards because mobile payments are fully encrypted and tokenized. This means that no actual card or account numbers are stored within your digital wallet.

It works like this: the personal information you enter into a digital wallet is encrypted and turned into a unique code that only authorized parties can read.

Digital wallets take things a step further with the addition of tokenization, which transforms sensitive encrypted data into a non-sensitive digital equivalent known as a token. Every time a user makes a payment, these particular tokens are randomly created, and only the merchant’s payment gateway can match them in order to accept the payment.

The bottom line is that your information is useless and unreadable to fraudsters when encryption and tokenization work together.

Pay With Ease & Peace of Mind With Digital Wallets

Digital wallets are a simple and secure alternative to carrying multiple cards and a whole wad of cash wherever you go. And while there are still features that app developers can improve, digital wallets are quickly replacing cash as the preferred payment method for many customers due to their convenience, ease of use, and versatility.

For more insightful articles like this, check out NewPakWeb today!