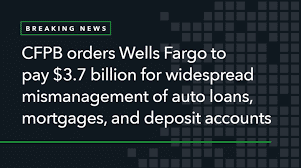

Wells Fargo and the Consumer Financial Protection Bureau (CFPB) have agreed to a $3.7 billion settlement to settle claims that the bank took advantage of its customers.

The CFPB told Wells Fargo to pay $3.7 billion because it messed up auto loans, mortgages, and deposit accounts, which hurt its customers’ finances by billions of dollars and cost many of them their cars or homes.

Soon after the CFPB sent out its press release, Wells Fargo sent out its own to confirm that it had agreed to the settlement.

Since 2018, Wells Fargo has had to settle with the CFPB (in 2018 and again in 2022), the Office of the Comptroller of the Currency (2018), and the U.S. Department of Justice (2018). (2020).

ALSO READ: Best Professional Liability Insurance as of 2022

The Wells Fargo fee breaks the CFPB’s previous record.

On Nov. 4, 2022, a Bloomberg report said that the CFPB would fine Wells Fargo more than $1 billion for allegedly mistreating its customers. The settlement hadn’t been finalized at the time, but the report suggested that the payment would happen. This amount would have been a new high for the government agency, which in 2018 fined Wells Fargo $500 million.

But on Tuesday, the CFPB said in a press release that Wells Fargo would have to pay more than they had thought. The order calls for Wells Fargo to pay over $2 billion to consumers. A $1.7 billion civil penalty, will go to the CFPB’s Civil Penalty Fund. Wells Fargo will also have to stop charging unexpected overdraft fees and make sure that borrowers of auto loans get their money back for some add-on fees. It said in its press release that it had agreed to the settlement.

Wells Fargo’s recent trouble with the government

The CFPB says that Wells Fargo broke the law in the following ways:

Wells Fargo misapplied auto loan payments and, consequently, wrongly charged fees and interest and repossessed borrowers’ cars without their permission. It also didn’t give back some fees for add-on products when a loan was paid off early. Over 11 million accounts were hurt by these mistakes in how auto loans were serviced, costing $1.3 billion.

They were mistakenly Turning Down Mortgage Loan Modifications. For at least seven years, Wells Fargo turned down thousands of mortgage loan modifications that should have been approved. This led to wrongful foreclosures that cost some people their homes. The financial services company knew about this problem for years before it was finally fixed.

Surprise overdraft fees were charged illegally for years by Wells Fargo on debit card transactions and ATM withdrawals even though customers had enough money in their accounts to cover the trade when the bank approved it.

Wells Frago Freezing Consumer accounts

They were illegally Freezing Consumer Accounts and Misrepresenting Fee Waivers. The bank froze over 1 million consumer accounts because a faulty automated filter flagged potentially fraudulent deposits. This kept customers from getting to their money in Wells Fargo accounts for an average of two weeks. The financial services company also claimed that waivers could be obtained for a monthly service fee.

In the past few years, Wells Fargo has had to settle with the government more than once. As part of the same settlement, the financial services company had to pay $500 million to the CFPB and the Office of the Comptroller of the Currency in 2018. This was because of several bad practices in its auto lending and mortgage lending divisions. And in 2020, Wells Fargo settled with the U.S. Department of Justice for $3 billion for opening millions of customer accounts without their permission.

ALSO READ: Trupanion Pet Insurance Review as of 2022