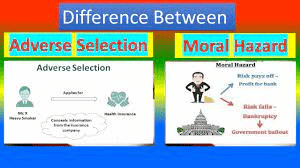

In economics, risk management, and insurance. The terms “moral hazard” and “adverse selection” are used to talk about situations in which the actions of another party hurt one party.

A moral hazard happens when two parties don’t have the same information. And one party changes their behavior after they reach an agreement. When one person in a transaction knows more about a subject than the other, this is called “asymmetric information.” Moral hazard often happens in the lending and insurance industries but can also occur between employees and employers. When two people agree to do something together, there can be moral risks.

Adverse selection is when sellers know more about some aspect of a product’s quality than buyers do or vice versa. Most of the time, though, the seller is the one who knows more. This is called adverse selection, when unequal information is used to make decisions.

ALSO READ: What Is the Difference Between Facultative and Treaty Reinsurance?

Moral Hazard

In a moral hazard situation. One party to an agreement gives false information or changes their behavior after the deal has been made because they think they won’t be held accountable for their actions. When someone or something doesn’t have to pay the total cost of risk. They may have a reason to take on more risk. This choice is based on what will help them the most.

There is always a chance that one party to a contract did not do so in good faith. This could be because they gave false information about their assets, debts, or ability to get credit. This can happen in contracts between a borrower and a lender in the financial world. Moral hazard happens a lot in the insurance business as well.

Moral Hazard: An Example

Take the case of a homeowner who lives in a flood zone but does not have homeowners or flood insurance. The homeowner is prudent and pays for a home security system to help keep thieves away. When there are storms, they clear the drains and move furniture to avoid damage from flooding.

But the homeowner is tired of constantly worrying about burglaries and preparing for floods. So they buy home and flood insurance. After getting insurance for their house, they change how they act. They stop paying for their home security system and do less to prepare for possible flooding. There is a higher chance that someone will file a claim against the insurance company because of damage from flooding or loss of property.

The history of moral risk

Researchers at The Ohio State University and Boston University, Allard E. Dembe and Leslie I. Boden, found that insurance agents in England frequently used the term “moral hazard.” Early uses of the word “moral” meant dishonest and immoral behavior. Still, the word “moral” has also been used to indicate “subjective” behavior in mathematics. So it is not clear what the ethical implications of the word are. In the 1960s, economists started looking into moral hazards again. At this time, economists used the term “moral hazard” to discuss problems when risks can’t be fully understood. It had nothing to do with the morals of the people involved.

The Wrong Choice

When one side of a deal has more accurate and different information than the other, this is called “adverse selection.” The person or group with less information is at a disadvantage compared to the one with more. This difference means that the price and number of goods and services provided are not as good as they could be. Most information in a market economy is passed through fees, which means bad things happen when prices don’t work as they should.

One Case of Unfavorable Selection

For example, there are two types of people in the population: those who smoke and don’t exercise and those who don’t smoke and do exercise. People who smoke and don’t work out have a shorter life expectancy than people who don’t smoke and choose to work out. Let’s say two people want to buy life insurance: one smokes and doesn’t work out, and the other doesn’t smoke and works out every day. Without more information, the insurance company can’t tell the difference between the person who smokes and doesn’t work out and the other person.

Which one is Favourable?

The insurance company gives the people questionnaires to fill out so they can find out more about themselves. But the person who smokes and doesn’t exercise knows that if they answer honestly, their insurance rates will go up. This person decides to tell a lie and say they don’t smoke and work out every day. This is called adverse selection, meaning the same premium will be charged to both people. But insurance is worth more to a smoker who doesn’t work out than a non-smoker. The smoker who doesn’t exercise will need more health insurance and benefit from the lower premium in the long run.

Insurance companies are less likely to have to pay out big claims when they limit their coverage or raise their rates. Insurance companies try to prevent this by finding groups of people more likely to have a claim than the general population and charging them more for insurance. Life insurance underwriters look at people who want life insurance and decide whether or not to give them coverage and how much to blame them for premiums. Underwriters usually look at everything that could affect a person’s health, such as their height, weight, medical history, family history, job, hobbies, driving record, and smoking habits.

ALSO READ: Best Professional Liability Insurance as of 2022