The World Bank says that the world economy is “dangerously close” to going into recession.

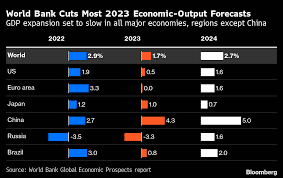

- The World Bank cut its prediction for the world economy’s growth in 2023 from 3% to 1.7%.

- In 2023, the U.S. GDP is only expected to grow by 0.5%, which is the worst prediction in 30 years.

- The new estimates were made because of higher inflation, higher interest rates, less investment, and the effects of Russia’s invasion of Ukraine.

ALSO READ: Inflation Hits – New York and Singapore Replace Tel Aviv as Most Expensive Cities

World Bank estimates of GDP growth

The World Bank cut its predictions for the growth of the world economy this year and said that it wouldn’t take much for the world economy to fall into a recession.

The bank now thinks that the global gross domestic product (GDP) will grow by 1.7% instead of the 3% it thought. It also cut its forecast for 2024 to a 2.7% gain.

The World Bank thinks the U.S. GDP might only grow by 0.5% this year, 1.9 percentage points less than its previous prediction and the worst performance outside of recessions since 1970.

The group said the drop in its outlook was due to high inflation, high-interest rates, less investment, and the effects of Russia’s invasion of Ukraine.

Risks of a Recession

The bank also said that any new bad news, like higher-than-expected inflation, sudden jumps in interest rates to control it, a rise in COVID-19 cases, or rising geopolitical tensions, could cause a recession because of the “fragile economic conditions.” It said that if that happens, it would be the first time in more than 80 years that two recessions happened in the same decade.

David Malpass, president of the World Bank Group, said that emerging and developing economies are especially likely to see their growth slow “as advanced economies with high government debt and rising interest rates suck up global capital.”

ALSO READ: Small Businesses Face Labor Shortages and Inflation – How they survive